How Many Bitcoin Are There: How Many Bitcoin Are There? BTC Supply Guide 2026

Discover how many Bitcoins are in circulation, the 21 million BTC supply cap, mining rates, and what happens when all coins are mined. Slug: how-many-bitcoin-are-there

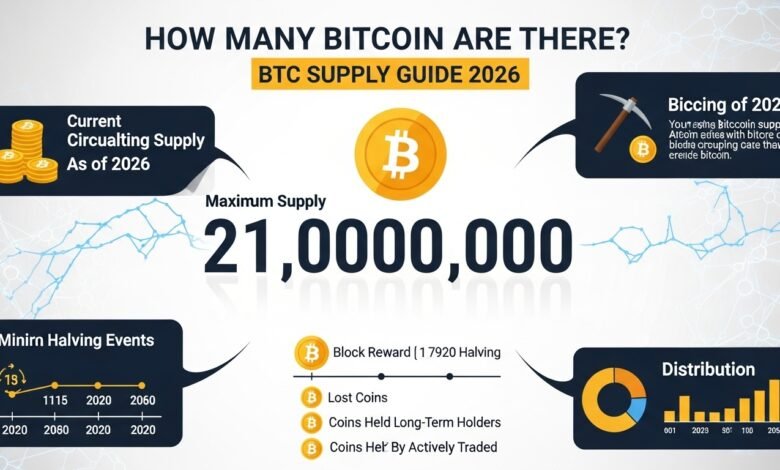

How many Bitcoins are there is fundamental to grasping the cryptocurrency’s value proposition and scarcity model. As of January 2026, approximately 19.6 million Bitcoins exist in circulation, but this number tells only part of the story. The total Bitcoin supply is capped at exactly 21 million coins, a hard limit coded into the protocol by its mysterious creator, Satoshi Nakamoto. This digital scarcity makes Bitcoin fundamentally different from traditional fiat currencies that governments can print indefinitely. The question of how many Bitcoins are there becomes even more intriguing when you consider that millions of coins are lost forever, and new BTC continues to enter circulation through mining at a predictable, decreasing rate.

Total Bitcoin Supply Cap

The 21 million Bitcoin limit represents one of the most revolutionary aspects of cryptocurrency economics. Unlike central banks that can expand the money supply at will, Bitcoin’s maximum supply is mathematically enforced through its underlying code. This predetermined scarcity was intentionally designed to create a deflationary asset similar to precious metals like gold.

When Satoshi Nakamoto launched Bitcoin in January 2009, the protocol established that only 21 million coins would ever exist. This isn’t an arbitrary number but rather a consequence of Bitcoin’s halving mechanism combined with its block reward schedule. The original block reward started at 50 BTC per block, halving approximately every four years or every 210,000 blocks mined.

The mathematical precision behind this supply cap ensures that even as Bitcoin continues to be mined well into the 22nd century, the total number will asymptotically approach but never exceed 21 million. Currently, more than 93% of all Bitcoin that will ever exist has already been mined, leaving fewer than 1.4 million BTC yet to be discovered through the mining process.

This fixed supply creates what economists call absolute scarcity in the digital realm. Unlike gold, where new deposits might be discovered or mining technology might improve extraction rates, Bitcoin’s total supply remains completely predictable and unchangeable without consensus from the entire network.

How Many Bitcoin Are Currently in Circulation?

As of January 2026, approximately 19.6 million Bitcoin are in circulation, representing about 93.3% of the total supply that will ever exist. However, the term “in circulation” requires careful examination because not all mined Bitcoin are actively tradable or accessible.

The circulating Bitcoin supply differs significantly from the total mined amount due to several factors. Research suggests that between 3 and 4 million Bitcoin may be permanently lost, locked in wallets whose private keys have been forgotten, destroyed, or whose owners have passed away without sharing access information. These lost coins effectively reduce the actual circulating supply, making Bitcoin even scarcer than the raw numbers suggest.

Every day, approximately 450 new Bitcoin enter circulation through mining rewards, though this number decreases with each halving event. Miners solve complex cryptographic puzzles to validate transactions and secure the network, receiving newly minted Bitcoin as compensation. This controlled emission rate ensures gradual distribution rather than instant creation of all coins.

The Bitcoin in circulation also includes coins held by long-term investors who haven’t moved their holdings in years, often called “HODLers” in cryptocurrency terminology.

Major institutions, corporations, and governments now hold significant Bitcoin reserves. Companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets, while certain nations have accumulated BTC through various means. These holdings, while technically in circulation, often remain dormant for extended periods as part of long-term investment strategies.

The Bitcoin Mining Process and Supply Rate

Bitcoin mining serves as the mechanism through which new coins enter circulation while simultaneously securing the network. Miners compete to solve complex mathematical problems, and the first to find a valid solution earns the right to add a new block to the blockchain and claim the block reward.

The current Bitcoin block reward stands at 3.125 BTC per block as of the April 2024 halving event. This reward gets cut in half approximately every four years, creating a predictable supply schedule. When Bitcoin launched in 2009, miners received 50 BTC per block. This reward decreased to 25 BTC in 2012, then 12.5 BTC in 2016, 6.25 BTC in 2020, and most recently to 3.125 BTC in 2024.

New blocks are mined approximately every 10 minutes, maintained through a self-adjusting difficulty mechanism. If miners collectively increase their computational power and blocks arrive faster than the 10-minute target, the difficulty automatically increases. Conversely, if mining power decreases and blocks slow down, the difficulty adjusts downward to maintain the steady rhythm.

This means roughly 144 blocks are mined daily, currently adding about 450 new Bitcoin to circulation each day. However, this rate continues to decline with each halving event. By 2028, the next halving will reduce the block reward to approximately 1.5625 BTC, further slowing the rate at which Bitcoin supply increases.

The mining reward schedule ensures that Bitcoin inflation decreases over time, eventually approaching zero. This programmed scarcity stands in stark contrast to fiat currencies, where inflation rates fluctuate based on monetary policy decisions. The predictability of Bitcoin’s emission rate allows investors and economists to model future supply with mathematical precision.

Bitcoin Halving Events and Supply Impact

Bitcoin halving events represent the most significant scheduled changes to the supply dynamics of the cryptocurrency. These halvings occur approximately every four years and cut the mining reward in half, directly impacting how quickly new Bitcoin enters circulation.

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 to 25 BTC. At that time, the Bitcoin price hovered around twelve dollars, and the event received relatively little mainstream attention. The second halving in July 2016 cut rewards to 12.5 BTC per block, followed by the third halving in May 2020 that reduced rewards to 6.25 BTC.

Most recently, the April 2024 halving event reduced the block reward to 3.125 BTC per block, marking a significant milestone in Bitcoin’s supply schedule.

Historically, Bitcoin halvings have preceded significant bull markets, though correlation doesn’t guarantee causation. The reduced rate of new supply entering the market, combined with steady or increasing demand, creates favorable conditions for price appreciation according to basic economic principles.

This transition from block rewards to fee-based compensation represents a fundamental shift in Bitcoin’s economic model, though it remains decades away.

Lost Bitcoin and Actual Available Supply

These losses occur through various scenarios, including forgotten passwords, misplaced hardware wallets, damaged storage devices, and deaths without proper inheritance planning. In the early days of Bitcoin, when the cryptocurrency held minimal value, many users were less careful about securing their private keys.

One of the most famous cases involves an estimated 1 million Bitcoin potentially controlled by Satoshi Nakamoto that have never moved since being mined in 2009 and 2010. While technically not lost, these coins remain dormant and their status creates uncertainty about the true available Bitcoin supply.

Other notable Bitcoin losses include the approximately 7,500 BTC in a hard drive discarded by James Howells in 2013, now buried in a UK landfill. Individual stories like these, combined with countless smaller incidents, accumulate into millions of permanently lost coins.

Blockchain analysis firms use various metrics to estimate lost Bitcoin, including examining wallets with no outgoing transactions for extended periods, coins sent to provably unspendable addresses, and statistical modeling of loss rates over time. These analyses suggest that the actual circulating supply of accessible Bitcoin may be significantly lower than the mined total.

This unintentional scarcity actually enhances Bitcoin’s value proposition for remaining holders. As the available supply decreases while demand potentially increases, basic economic principles suggest upward price pressure. The lost coins essentially represent a deflation mechanism built into Bitcoin through human error rather than protocol design.

What Happens When All Bitcoin Are Mined?

This shift raises important questions about network security and miner incentives. For Bitcoin to remain secure, transaction fees must be sufficient to compensate miners for the substantial computational resources required to maintain the network.

The Bitcoin transaction fee market will need to mature significantly to support mining operations in a post-reward era. As Bitcoin adoption grows and transaction volume increases, fee revenue should theoretically rise to sustainable levels.

Some analysts express concern about whether transaction fees alone can maintain adequate network security once block rewards end. Others argue that over a century of gradual transition provides ample time for fee markets to develop, scaling solutions to mature, and the Bitcoin ecosystem to adapt organically to changing economic realities.

Layer-two solutions like the Lightning Network may also play a crucial role in Bitcoin’s post-mining era. By enabling millions of transactions off-chain while periodically settling to the main blockchain, these technologies can increase Bitcoin’s transaction capacity while generating fee revenue for miners through channel openings, closings, and periodic settlement transactions.

The end of Bitcoin mining rewards doesn’t mean the end of Bitcoin itself. The cryptocurrency will continue functioning as a decentralized, peer-to-peer payment system and store of value, with its fixed supply potentially making it even more attractive as a hedge against inflation in traditional financial systems.

Bitcoin Distribution and Whale Holdings

Understanding Bitcoin distribution reveals important insights about wealth concentration within the cryptocurrency ecosystem.

Current data shows that a relatively small number of addresses hold substantial Bitcoin amounts, often referred to as “whales” in cryptocurrency terminology. Addresses holding 1,000 or more Bitcoin collectively control a significant portion of the total supply, though many of these addresses belong to cryptocurrency exchanges holding customer funds rather than individual whales.

The largest Bitcoin holders include cryptocurrency exchanges like Binance, Coinbase, and Kraken, which maintain enormous wallets to facilitate customer trading. These custodial holdings represent thousands or millions of individual users rather than single entities, making direct comparisons to individual whale holdings somewhat misleading.

Individual Bitcoin whales certainly exist, with early adopters and investors who accumulated substantial positions when Bitcoin traded for dollars or even cents. These holders wield considerable market influence, as large transactions can impact price discovery and market sentiment. However, blockchain analysis suggests that most large holders tend to be long-term investors rather than active traders.

Studies show that while Bitcoin distribution is unequal, it’s becoming gradually more distributed over time as adoption spreads and new participants enter the market. This trend suggests healthy ecosystem growth rather than increasing concentration.

Institutional Bitcoin holdings have grown dramatically in recent years, with publicly traded companies, investment funds, and even government entities accumulating significant positions. This institutional adoption represents a maturation of the cryptocurrency market, though it also raises questions about Bitcoin’s original vision of decentralized, peer-to-peer currency free from institutional control.

Bitcoin Supply Compared to Other Cryptocurrencies

When examining Bitcoin’s supply model in comparison to other cryptocurrencies, several fundamental differences emerge that help explain Bitcoin’s unique position in the market. While thousands of cryptocurrencies exist, Bitcoin’s fixed supply of 21 million coins remains one of its most distinguishing and valued characteristics.

Ethereum, the second-largest cryptocurrency by market capitalization, originally had no maximum supply cap. However, recent protocol changes have introduced burning mechanisms that make Ethereum potentially deflationary depending on network usage. This variable supply model contrasts sharply with Bitcoin’s predictable issuance schedule.

Many altcoins have chosen different supply models entirely. Ripple (XRP) pre-mined its entire supply of 100 billion tokens before launch, with the company controlling a substantial portion for distribution over time. This centralized approach to cryptocurrency supply differs fundamentally from Bitcoin’s decentralized, mining-based emission.

Some newer cryptocurrencies have adopted even more aggressive scarcity models, with maximum supplies in the millions or even thousands of coins. However, simple numerical scarcity doesn’t automatically confer value. Bitcoin’s 21 million supply cap holds significance because of the network’s security, adoption, liquidity, and first-mover advantage rather than the number itself.

The Bitcoin supply schedule has been successfully operating for over 15 years without changes, demonstrating the protocol’s resistance to inflation pressure and maintaining the social contract with holders. This consistency builds trust and predictability that many newer cryptocurrencies lack, as their protocols may change based on developer or community decisions.

Future Projections for Bitcoin Supply

Looking ahead to 2040, over 20.4 million will exist, accounting for more than 97% of the maximum supply. At this point, block rewards will have decreased to just 0.1953125 BTC per block, with fewer than 30 new coins entering circulation each day. The annual inflation rate of Bitcoin will be effectively negligible, approaching the theoretical permanence of elements like gold.

Bitcoin supply projections for 2050 show approximately 20.6 million coins in circulation, with block rewards reduced to minuscule fractions of a Bitcoin. By this time, transaction fees will likely constitute the majority of miner revenue, completing the transition from a reward-based to a fee-based mining economy.

The final century of Bitcoin mining, from 2040 to 2140, will see the last million coins slowly distributed across increasingly smaller reward amounts. These fractional Bitcoin additions will have minimal impact on supply inflation but maintain the mining incentive structure during the critical transition period.

Long-term Bitcoin adoption scenarios suggest various potential outcomes for how this supply schedule impacts price and usage. In scenarios where Bitcoin becomes a globally adopted reserve asset or primary store of value, the combination of fixed supply and growing demand could drive significant appreciation. Alternative scenarios where cryptocurrencies face regulatory challenges or technological disruption might limit adoption regardless of supply constraints.

Climate considerations may also influence future Bitcoin mining operations, as the network’s energy consumption receives increasing scrutiny. Innovations in renewable energy for mining operations and improvements in chip efficiency could make Bitcoin mining more sustainable as block rewards decrease and energy economics become more critical to profitability.

Key Factors Affecting Bitcoin’s Perceived Supply

Bitcoin held on exchanges represents the most immediately available supply for trading. When exchange reserves decrease, it typically signals investors moving coins to cold storage for long-term holding, reducing liquid supply and potentially supporting price appreciation. Conversely, increasing exchange reserves might indicate preparation for selling, adding to the available supply.

The long-term holder supply metric tracks Bitcoin that hasn’t moved in extended periods, often considered removed from active circulation. Studies show that a substantial portion of Bitcoin supply hasn’t transacted in years, suggesting strong holder conviction and reduced selling pressure. This behavior effectively decreases the active circulating supply available for price discovery.

Regulatory developments significantly impact perceived Bitcoin supply and demand dynamics. Countries that embrace Bitcoin with clear regulatory frameworks tend to increase institutional participation and demand, while hostile regulatory environments can suppress demand or force supply into less liquid markets.

Growing payment adoption locks Bitcoin in transaction channels, while increased store-of-value adoption removes coins from circulation into long-term storage. These competing use cases create complex supply dynamics within the constrained total issuance.

Technological improvements in Bitcoin’s infrastructure, including the Lightning Network and other layer-two solutions, enable more efficient use of the existing supply. These technologies allow the same Bitcoin to facilitate exponentially more transactions, effectively multiplying the utility of the fixed supply without inflating the base layer.

During periods of monetary expansion and currency devaluation, Bitcoin’s fixed supply becomes more attractive as an inflation hedge. Economic uncertainty often drives increased demand for scarce assets with predictable supply schedules.

Conclusion

Understanding how many Bitcoins are there provides crucial insight into what makes this cryptocurrency unique and valuable in an increasingly digital financial landscape. With approximately 19.6 million Bitcoin in circulation as of 2026 and a hard cap of 21 million coins, Bitcoin represents the first successfully implemented digital scarcity in human history.

The Bitcoin supply model combines mathematical certainty with economic incentives to create a self-regulating monetary system independent of central authority. This fixed supply, coupled with growing global adoption, positions Bitcoin as a potential long-term store of value resistant to the inflation that affects fiat currencies. Whether you’re an investor evaluating scarcity premium, a developer building on the protocol, or simply curious about cryptocurrency economics, grasping the fundamentals of supply dynamics is essential.

As it continues maturing toward its final supply limit over the next century, the cryptocurrency faces both challenges and opportunities. The transition from block rewards to transaction fees, the impact of lost coins on actual supply, and evolving regulatory landscapes will all shape how Bitcoin’s fixed supply influences its role in the global economy. Ready to dive deeper into? Start by tracking how many are there in real-time through blockchain explorers and continue your education about this revolutionary digital asset.

See more; Bitcoin Slips Below $90K: Whale Selling Intensifies