Bitcoin Is Down 30%: Why History Says Relax

Bitcoin is down nearly 30% from its record high. Discover why this drop is normal, what history shows, and how smart investors handle the volatility.

Over the past couple of months, Bitcoin has slipped from record highs above the six-figure mark and now trades at roughly a 30% drawdown from its latest peak. Depending on the exact exchange and day you check, the current drawdown sits around the high-20s to low-30s percent range from the all-time high above $120,000 reached in mid-2025.

Headlines shouting that “Bitcoin is down nearly 30% from its record high” can sound alarming, especially to newer investors who entered the crypto market near the top. But if you zoom out even a little, history shows this kind of pullback is not just common, it is entirely normal for this digital asset. Bitcoin’s price history is filled with multiple drawdowns of 50%, 60%, 80% and even more, often within the same long-term bull market.

In this article, we will unpack what a 30% drop really means in context, how previous cycles played out, why Bitcoin volatility is baked into the asset’s design, and what these moves can signal for long-term investors. We will also talk about practical risk management, so you can navigate this environment without panicking at every red candle.

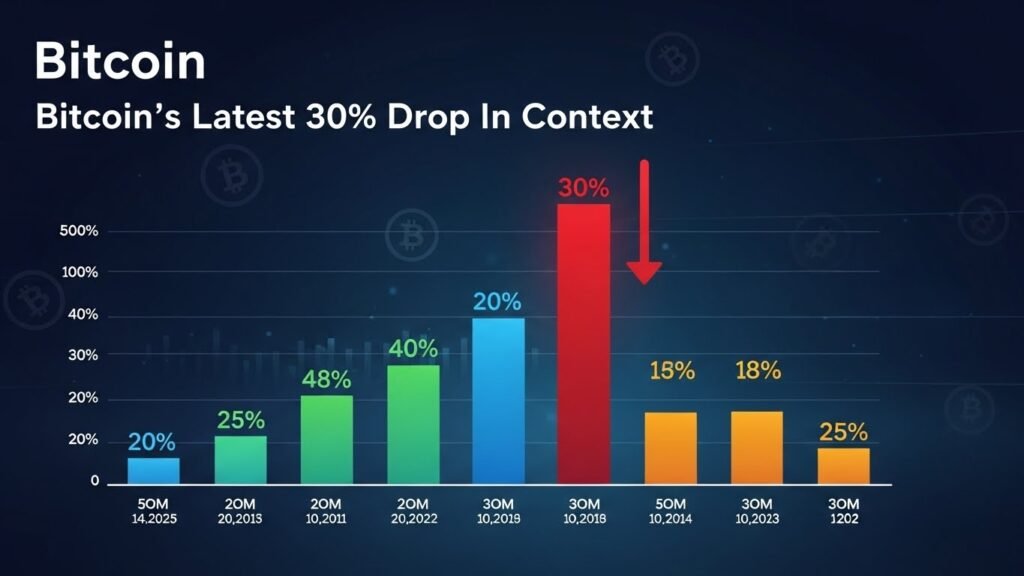

Bitcoin’s Latest 30% Drop In Context

After roaring to a new all-time high above $120,000 in July 2025, Bitcoin began to cool off. Recent data shows the market is now roughly 27%–33% below that peak, depending on whether you measure from the July highs around $120K–$123K or the later spike above $126K on some exchanges.

This is not a sudden overnight collapse. Instead, it has been a multi-week price retracement, driven by a combination of factors:

In other words, this is a typical cool-down phase after a powerful rally. On a chart, it looks sharp. In the context of Bitcoin’s full history, it looks relatively mild.

Why “Down 30%” Isn’t The Catastrophe It Sounds Like

In traditional stock markets, a 20% move down is usually labeled a bear market. For a blue-chip stock index like the S&P 500, a 30% drawdown is a historic event. For Bitcoin, it is almost a routine part of the market cycle.

Historically, Bitcoin has experienced multiple drawdowns of 70%–90% from prior highs, usually clustered around the explosive tops that follow each halving cycle. Research from firms like NYDIG and Bankrate highlights major declines of approximately 86% from 2013 to 2015, 84% from 2017 to 2018, and 77% from 2021 to 2022.

Against that backdrop, a 30% correction feels far less extreme. It may be painful for those who bought at the very top, but it is well within the “normal” range of Bitcoin volatility observed during ongoing bull markets, not just during brutal bear markets.

A Quick Tour Through Bitcoin’s Biggest Drawdowns

To understand why this current pullback may be “normal,” it helps to revisit some of Bitcoin’s earlier price crashes and what happened after them.

Early Cycles: From Pennies To Hundreds To Thousands

In the early 2010s, Bitcoin went from being nearly worthless to trading at tens and then hundreds of dollars. These rapid gains were followed by extreme collapses. In June 2011, for example, Bitcoin crashed around 99% from about $32 to a tiny fraction of a dollar after the Mt. Gox hack.

Later, from November 2013 to early 2015, Bitcoin fell more than 80% from its then-record high above $1,100, wiping out years of gains in a matter of months before slowly recovering and eventually soaring to new levels.

These early cycles established a pattern: powerful parabolic rallies followed by deep bear markets, during which Bitcoin would trade at a fraction of its former peak before eventually resuming its long-term uptrend.

2017–2018 And 2021–2022: Crashes In A More Mature Market

By the time Bitcoin hit nearly $20,000 in late 2017, it was already a global phenomenon. Yet even with more adoption, the pattern persisted. From December 2017 to December 2018, the price dropped roughly 84%, crashing from around $19,700 to near $3,100.

The story repeated again after the 2021 peak near $69,000. A combination of rising interest rates, macro worries, and high-profile collapses like Terra/Luna and FTX drove Bitcoin into a prolonged crypto winter, with prices falling more than 70% from the highs.

Despite these brutal cycles, the long-term trajectory has been up. Each time, after a period of capitulation and accumulation, Bitcoin eventually reclaimed its previous high and set a new one, driven by fresh adoption, technological maturation, and macro trends.

Why Bitcoin Is So Volatile By Design

Understanding Bitcoin’s built-in volatility is key to understanding why a 30% move down can be normal.

Limited Supply And A Global, 24/7 Market

Bitcoin has a fixed maximum supply of 21 million coins, with new issuance cut roughly in half every four years in an event called the halving. This hard cap, combined with a still-growing demand base, means relatively small changes in buying or selling pressure can cause large price swings.

On top of that, Bitcoin trades 24/7 across thousands of exchanges worldwide. There is no circuit breaker, no “market closed” period, and no central bank actively stepping in to stabilize the crypto market. When sentiment shifts, it often shifts quickly, and that is reflected in the price.

Speculation, Leverage And Narrative Whiplash

When narratives change – for example, when interest-rate policy shifts or when ETF flows slow – leveraged positions can be forced to unwind, amplifying moves in both directions. This is why Bitcoin often overshoots both on the upside and downside.

The result is an asset whose volatility is much higher than traditional stocks or bonds. For long-term believers in the technology, this volatility is the “price of admission” to an asset that has historically delivered outsized returns over multi-year periods.

Why History Shows 30% Pullbacks Are Normal In Uptrends

If you look not just at the huge 70%–90% crashes, but at the drawdowns that occur within major bull markets, you see another clear pattern: Bitcoin regularly experiences 20%–40% corrections even as its long-term trend remains upward.

Analytics sites that track Bitcoin drawdown from all-time high show that double-digit pullbacks are frequent during strong uptrends. The current drawdown of around 27%–30% from the October and July highs fits right into that historical behavior.

These “corrections within a bull market” serve a function. They shake out over-leveraged traders, reset funding rates, allow long-term holders to accumulate, and let the market digest previous gains. In hindsight, many of these 30% drops looked like noisy pauses in a much bigger uptrend.

That does not guarantee that every 30% drop will be followed by new highs, but history suggests that such drawdowns on their own are not unusual or automatically bearish.

What This Drop Might Be Signaling Now

So what could this particular 30% drop be telling us about Bitcoin’s current market phase?

A Normal Cool-Down After New All-Time Highs

Bitcoin recently broke its 2021 record and pushed into an entirely new price regime above $120K, driven in part by spot ETF inflows and renewed institutional interest.

After such a move, it is natural for early buyers to take profits and for new buyers near the top to feel nervous. This is a classic setup for a reversion to the mean, where price pulls back toward prior support zones and more sustainable valuation levels.

The current move down fits that narrative: a strong bull run, followed by a period where the market is searching for a new equilibrium between enthusiastic long-term holders and short-term traders looking to exit.

Macro Headwinds And Sentiment Swings

It is not happening in a vacuum. The broader risk-asset environment has been choppy. Shifts in central bank policy, worries about growth, regulatory headlines, and ETF flow reversals have all played a role in cooling risk appetite.

Bitcoin, being a high-beta asset, reacts quickly to those changes. When investors rotate toward safer assets like bonds or cash, they often cut back on speculative crypto positions first. That can accelerate downside moves, even if the longer-term adoption story remains intact.

How Long-Term Investors Typically Respond

Understanding that this kind of drawdown is historically normal does not mean you should blindly buy every dip. But it does shape how many long-term investors choose to respond.

Focusing On Time Horizon Instead Of Daily Price

Short-term price swings, even big ones, matter less if your time horizon is measured in years. This does not make losses feel good, but it helps frame a 30% pullback as part of a noisy journey, rather than as a verdict on Bitcoin’s ultimate fate.

Using Volatility As A Risk-Management Signal

For more active investors, Bitcoin volatility is not just a source of stress but also a signal. A sharp drop can be a reminder to:

Traditional wealth managers often suggest keeping highly speculative assets, including cryptocurrencies, to a relatively small percentage of a diversified portfolio. While specific numbers vary by advisor, the idea is the same: size your exposure so that even a 50%–80% drawdown does not destroy your financial plan.

Practical Tips For Navigating A 30% Bitcoin Drawdown

Again, this is not financial advice, but there are some widely used principles that many investors apply when dealing with a volatile asset like Bitcoin.

If your original thesis still holds, a price move – even a large one – may not automatically invalidate it. If your thesis has changed, or if you realize you never really had one beyond “number go up,” this may be a good time to reassess and reset expectations.

2. Check Your Risk, Not Just Your Returns

In a high-volatility asset, risk management matters as much as potential gains. Consider whether:

You can emotionally handle further downside without panic-selling.

>You are overexposed to a single asset relative to your income, savings, or other investments.

>You are prepared to hold through extended “12953”>bear markets, not just quick pullbacks.

If the answer to any of these is no, it may be a sign that your position size is too large for your circumstances.

3. Avoid Emotional Decisions

Sharp moves often create emotional whiplash: euphoria near the top, fear near the bottom. Many investors regret buying aggressively into parabolic rallies or panic-selling near capitulation lows.

Stepping back, taking time to think, and making changes based on a calm reassessment of your strategy instead of day-to-day headlines can help you avoid the worst emotional mistakes.

What This Means For Bitcoin’s Long-Term Story

The key takeaway is simple: a 30% drop from a fresh all-time high is not unusual for Bitcoin. Historically, such drops have occurred multiple times during ongoing bull markets, not just at the start of brutal bear cycles.

None of this guarantees that the current drawdown will quickly reverse or that new highs are right around the corner. Markets can stay volatile and uncertain for longer than anyone expects. But if you understand that Bitcoin’s price path has always been jagged, the current move looks far less shocking.

In the big picture, Bitcoin has repeatedly transitioned from speculative curiosity to niche asset to institutional talking point. It has survived hacks, bans, crashes, and bear markets, only to re-emerge stronger as infrastructure improved, regulation matured, and adoption widened.

In that light, the headline “Bitcoin is down nearly 30% from its record high — history shows that’s normal” is less a warning siren and more a reminder of what this digital asset has always been: volatile, unpredictable in the short term, but remarkably resilient over the long term.

Conclusion

Bitcoin’s latest 30% slide from record highs can feel dramatic, particularly to those new to the crypto market or heavily exposed at the top. Yet when you study the asset’s history, a different story emerges. Past cycles featured drawdowns of 70%–90%, sometimes multiple times, on the path to ever higher peaks.

Today’s move looks more like a normal correction in a volatile asset than a singular, unprecedented disaster. It reflects profit-taking, changing macro conditions, and shifting sentiment, not necessarily the end of Bitcoin’s long-term narrative.

For investors, the most productive response is rarely panic. It is to revisit your thesis, reassess your risk management, and decide whether your exposure matches your time horizon and emotional tolerance. Bitcoin will almost certainly continue to be volatile. Whether that volatility is an opportunity or a threat depends on how you choose to engage with it.

FAQs

Q. Is a 30% drop in Bitcoin a sign that the bull market is over?

Not necessarily. Historically, Bitcoin has seen many 20%–40% pullbacks during active bull markets. These corrections often occur after strong rallies as traders take profits and over-leveraged positions unwind. While a 30% drawdown can precede a deeper bear market, it can also simply be part of a healthy cooling-off phase before the trend resumes.

Q. How does this 30% drawdown compare to past Bitcoin crashes?

Compared to past Bitcoin crashes of 70%–90%, the current drawdown is relatively modest. Previous cycles saw Bitcoin fall from around $1,100 to near $200, from nearly $20,000 to $3,000, and from $69,000 to below $20,000, each representing drawdowns of more than 75%.

Q. Does Bitcoin’s volatility mean it will never be a reliable store of value?

Bitcoin’s volatility is a double-edged sword. In the short term, it makes the asset feel unstable compared with traditional stores of value like bonds or gold.

Q. How much of my portfolio should be in Bitcoin during such volatile periods?

There is no one-size-fits-all answer, but many financial professionals treat Bitcoin as a high-risk, speculative asset and suggest keeping it to a relatively small portion of a diversified portfolio.

Q. What should new investors do if they bought near the top and are now sitting on losses?

If you are new to Bitcoin and bought near the recent record high, seeing a 30% drawdown can be emotionally tough. The most important first step is to pause and avoid emotional decisions.