The Warning Signal from Bitcoin’s Fall Investors Ignore

Discover what the warning signal from Bitcoin’s fall really means for crypto, stocks, and the global economy—and how to prepare for the next big move.

Fall Investors Ignore When headlines scream about bitcoin’s fall, most people focus on the red candles, liquidations, and social media panic. Traders obsess over intraday charts, long-term holders debate whether to buy the dip, and skeptics declare, once again, that Bitcoin is dead. But beneath the noise, each major downturn in Bitcoin’s price carries an important message. It is not just about losing market value; it is a warning signal that points to deeper issues in market behavior, investor psychology, liquidity conditions, and even the wider macroeconomic environment.

Bitcoin has always been more than a digital asset with a volatile chart. It acts as a kind of emotional mirror for the financial system, reflecting greed, fear, overconfidence, and sudden risk aversion. When bitcoin’s fall accelerates, it often exposes leverage bubbles, weak hands, unsustainable narratives, and blind trust in never-ending uptrends. At the same time, it can highlight shifting attitudes toward risk and reveal how tightly crypto is connected to big forces like interest rates, inflation, and global liquidity. Fall Investors Ignore.

This article explores the deeper meaning behind Bitcoin’s sharp declines, why these corrections are important warning signs rather than random crashes, and how both new and experienced investors can interpret them. We will look at how Bitcoin’s fall relates to sentiment, macroeconomics, market structure, and long-term adoption. The goal is not to scare you away from crypto, but to help you read the signals in a more informed way, so you can make better decisions when the market turns brutal.

Bitcoin’s Fall As A Sentiment Barometer

Before most large corrections, the market atmosphere around Bitcoin feels strangely similar: euphoric. Prices move aggressively upward, social media is filled with bold predictions, and many voices insist that “this time is different.” In those moments, discussing bitcoin’s fall seems almost absurd because most people only anticipate further gains. Yet this is exactly when risk is quietly building. As prices rise, more traders start to use leverage, small investors chase quick profits, and long-term analysis gets replaced by short-term excitement. The fear of missing out pushes people to buy even when they do not fully understand the asset or the risks involved. This creates an environment where any negative shock, however small, can trigger a chain reaction. Fall Investors Ignore.

Before most large corrections, the market atmosphere around Bitcoin feels strangely similar: euphoric. Prices move aggressively upward, social media is filled with bold predictions, and many voices insist that “this time is different.” In those moments, discussing bitcoin’s fall seems almost absurd because most people only anticipate further gains. Yet this is exactly when risk is quietly building. As prices rise, more traders start to use leverage, small investors chase quick profits, and long-term analysis gets replaced by short-term excitement. The fear of missing out pushes people to buy even when they do not fully understand the asset or the risks involved. This creates an environment where any negative shock, however small, can trigger a chain reaction. Fall Investors Ignore.

Fear, Panic Selling, And Capitulation

Just as euphoria dominates during bull runs, fear takes over during downturns. After a rapid decline, sentiment quickly swings from optimism to despair. Traders who were confident and loud on the way up become silent or start selling in panic. Social media feeds fill with bearish predictions, and the narrative changes from “Bitcoin to the moon” to “Bitcoin is going to zero.” This emotional shift is one of the clearest warning signals that bitcoin’s fall reveals. It reminds us how quickly human psychology can flip and how dangerous it is to make decisions purely based on crowd emotion. Panic selling often happens at or near the worst possible time, locking in heavy losses right before the market stabilizes or even begins to recover.

The Macro Message: Bitcoin’s Fall And Economic Conditions

From “Digital Gold” To High-Risk Asset

For years, Bitcoin has been described as digital gold, a hedge against inflation, money printing, and currency debasement. There is some truth to this narrative, especially over the very long term. However, in shorter timeframes, Bitcoin often behaves more like a high-risk asset than a traditional safe haven. When interest rates rise, liquidity tightens, or recession fears grow, investors frequently reduce exposure to volatile assets. That means speculative technology stocks, meme coins, and yes, Bitcoin. During these phases, bitcoin’s fall can be interpreted as a warning signal that the broader market is shifting from risk-on to risk-off behavior. In other words, Bitcoin can be an early indicator that investors are becoming more cautious.

Liquidity, Central Banks, And The Crypto Cycle

Another important factor behind bitcoin’s fall is global liquidity. When central banks are keeping interest rates low and supporting markets, liquidity flows into a wide range of assets, including cryptocurrencies. This abundant liquidity can fuel strong rallies, rapid accumulation phases, and record-breaking all-time highs. However, when central banks reverse course, raise interest rates, or signal tighter policy, liquidity begins to drain. Riskier assets are usually the first to react. As conditions become less favorable, leveraged positions become vulnerable, and even small drops can trigger forced selling. As Bitcoin falls, altcoins often fall even harder, magnifying the sense of crisis.

Structural Weakness: What Bitcoin’s Fall Reveals About The Market

Leverage, Liquidations, And Systemic Fragility

One of the most important lessons from any major downturn is how much hidden leverage was present in the system. During euphoric periods, traders frequently increase their exposure through margin trading, perpetual futures, and other derivatives. These positions can amplify gains on the way up but also multiply pain on the way down. When prices start dropping, these leveraged positions hit liquidation thresholds. Exchanges automatically close them to protect themselves, dumping large amounts of Bitcoin onto the market in a short time. This forced selling can accelerate bitcoin’s fall, turning a normal correction into a cascade. Every time such an event happens, it reveals something important about market structure: where the leverage was, how many traders were overexposed, and how centrally concentrated risk had become.

Centralized Platforms And Trust Risk

Another structural signal that emerges during bitcoin’s fall is the risk of overreliance on centralized platforms. When prices drop sharply, some exchanges may face liquidity issues, increased withdrawal requests, or technical problems. In extreme cases, platforms can freeze withdrawals or even collapse entirely if they have been mismanaging customer funds. Although Bitcoin itself is decentralized, many people still hold their assets on centralized exchanges, lending platforms, or custodians. When those entities fail, customers can lose access to their funds, regardless of what the Bitcoin network is doing. Each wave of crisis serves as a reminder that not all parts of the crypto ecosystem share Bitcoin’s decentralization and resilience.

The Psychological Warning: How Bitcoin’s Fall Tests Conviction

Short-Term Speculators Versus Long-Term Believers

Every severe decline separates two types of participants: short-term speculators and long-term believers. Speculators are usually highly leveraged, emotionally reactive, and focused on quick gains. When bitcoin’s fall begins, they are often forced out of the market at heavy losses. Long-term believers, on the other hand, tend to understand Bitcoin’s history, technological foundations, and long-term potential. They view volatility as part of the journey rather than a sign of failure. While they still feel the emotional impact of falling prices, they are less likely to make impulsive decisions.

Emotional Discipline As A Competitive Edge

In every financial market, emotional discipline is a powerful advantage. Bitcoin’s volatility compresses emotional cycles into shorter periods, making that discipline even more important. The speed and intensity of bitcoin’s fall can trigger reactions that later feel irrational: panic selling at the bottom, overtrading in frustration, or abandoning a well-thought-out plan. Recognizing that these emotional triggers are part of the game is itself a warning signal. It reminds investors to create clear strategies before volatility hits, not during it. Whether you decide to hold, reduce exposure, or wait for clarity, making the decision calmly and in advance is far more effective than improvising in panic.

Long-Term Perspective: Bitcoin’s Fall Within The Bigger Trend

Historical Drawdowns And Recovery Patterns

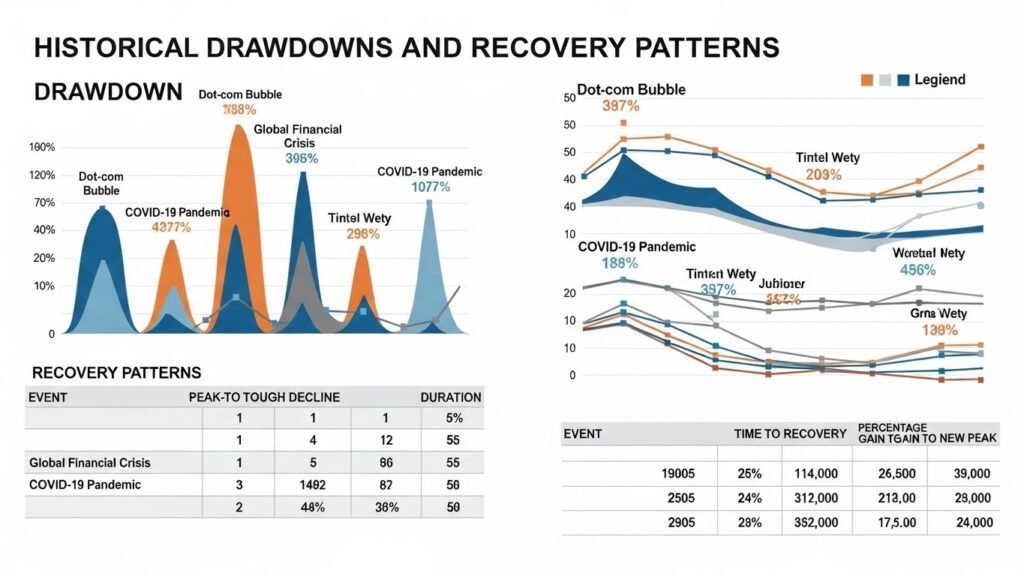

If you zoom out, one of the most striking things about Bitcoin is that it has experienced multiple large drawdowns throughout its history and yet continues to survive, adapt, and attract new users. Many past cycles have featured drops of 50% or more from all-time highs. Each time, the market sentiment swung from enthusiasm to despair, only for interest to slowly return later. This historical context does not guarantee future performance, but it does provide perspective. A single event of bitcoin’s fall can feel catastrophic in the moment, yet on a long-term chart, it may appear as part of a larger uptrend or as a consolidation phase before the next move.

If you zoom out, one of the most striking things about Bitcoin is that it has experienced multiple large drawdowns throughout its history and yet continues to survive, adapt, and attract new users. Many past cycles have featured drops of 50% or more from all-time highs. Each time, the market sentiment swung from enthusiasm to despair, only for interest to slowly return later. This historical context does not guarantee future performance, but it does provide perspective. A single event of bitcoin’s fall can feel catastrophic in the moment, yet on a long-term chart, it may appear as part of a larger uptrend or as a consolidation phase before the next move.

Adoption, Regulation, And Maturation

Bitcoin’s fall also intersects with broader themes of adoption and regulation. During periods of rapid price increases, new participants often join without doing proper research, simply chasing gains. When the market corrects, many of them leave, disillusioned. But some remain, study the technology, and become more committed.

Regulators also watch these cycles closely. Major crashes, exchange failures, or waves of liquidations often trigger renewed discussions about investor protection, clearer rules, and market transparency. Over time, these discussions can shape how Bitcoin and the wider crypto industry operate within the global financial system. In this way, bitcoin’s fall acts as a catalyst for maturation. It forces weak players out of the market, encourages better risk management, and pushes the ecosystem toward greater professionalism, even if that process is painful.

How Investors Can Interpret The Warning Signal

Rethinking Risk Management

One of the most actionable messages from bitcoin’s fall is the importance of risk management. Many investors only think about position size and diversification after they have lost money. A better approach is to decide in advance how much of your portfolio you are willing to allocate to Bitcoin and how much volatility you can tolerate without panicking. This includes setting clear rules about when to buy, when to sit on the sidelines, and when to take profits. It may also involve separating long-term holdings from short-term trades so that a sudden downturn does not force you to liquidate positions you intended to hold for years. The key warning from each major decline is simple: if one price swing can destroy your financial stability, your risk exposure was too high.

Focusing On Education, Not Hype

Another critical lesson from Bitcoin’s fall is the value of education. Hype comes and goes, but understanding remains. Investors who have taken the time to study how Bitcoin works, what problems it aims to solve, and how it fits into the broader financial system are less likely to be shaken out by temporary price movements. Each downturn is a reminder to step back from the noise and strengthen your knowledge. Learning about topics like on-chain data, market cycles, macroeconomics, and security practices can transform fear into informed caution. Rather than reacting blindly to bitcoin’s fall, educated investors use it as a moment to reassess assumptions, refine strategies, and improve their overall approach.

Conclusion: Listening Carefully To The Signal Behind The Noise

Bitcoin’s price will rise and fall many times. That is the nature of an emerging, highly speculative asset in a complex global economy. However, bitcoin’s fall is never just a random crash on a chart. It is a warning signal that highlights emotional extremes, structural weaknesses, liquidity changes, and shifting risk appetite. For those willing to pay attention, these warning signals are not reasons to abandon all hope. Instead, they are invitations to think more deeply, manage risk more carefully, and separate genuine conviction from passing excitement.

FAQs

Q. Does Bitcoin’s fall mean the end of the crypto market?

No, a single episode of bitcoin’s fall does not mean the end of the crypto market. Bitcoin has experienced multiple severe corrections throughout its history and has continued to survive and evolve. While each downturn can be painful and can drive weaker projects out of the space, it often leaves the ecosystem stronger, more mature, and better regulated than before.

Q. Why does Bitcoin fall so much compared to traditional assets?

Bitcoin is still a relatively young asset with a smaller overall market size and high speculative interest. This combination makes it more sensitive to changes in sentiment, liquidity, and leverage. As a result, price moves can be much sharper, both upward and downward. The same factors that produce rapid rallies can also lead to dramatic drops when conditions change. Fall Investors Ignore.

Q. What should I do when I see Bitcoin falling quickly?

The first step is to avoid reacting impulsively. Instead of making decisions in a panic, review your original investment plan and risk tolerance. Ask yourself whether your exposure to Bitcoin aligns with your financial goals and your ability to handle volatility. If you have a long-term strategy, short-term noise may not require immediate action. If you realize you were overexposed, it may be a signal to adjust your position size more thoughtfully, not hastily. Fall Investors Ignore.

Q. Is Bitcoin still a good long-term investment after a major fall?

Whether Bitcoin remains a good long-term investment depends on your personal beliefs, research, and financial situation. For some investors, bitcoin’s fall can represent a buying opportunity if they have strong conviction in its long-term potential and are prepared for continued volatility. For others, the emotional and financial stress of large drawdowns may be unacceptable. It is essential to base your decision on careful analysis rather than on fear or hype. Fall Investors Ignore.

Q. How can I protect myself from future Bitcoin crashes?

You cannot completely avoid volatility in Bitcoin, but you can reduce the damage it causes. Practical steps include limiting the portion of your portfolio allocated to crypto, avoiding excessive leverage, storing coins securely, and separating long-term holdings from short-term trades. Staying informed about macroeconomic conditions, market structure, and regulatory developments can also help you anticipate when risk may be rising. Most importantly, treat each episode of bitcoin’s fall as a lesson in risk management and emotional discipline, not just as a painful event to forget. Fall Investors Ignore.

See more;Bitcoin falls below $100,000 for the first time since late June