XRP Exchange Reserves Shed $1.32B Below Key MAs

XRP exchange reserves shed $1.32B as price trades below key moving averages. Discover what shrinking liquidity means for XRP price, risk and opportunity.

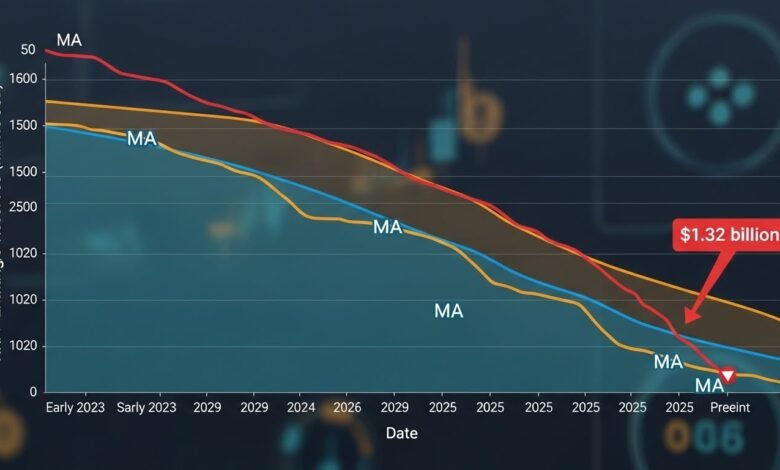

The XRP market is once again in the spotlight as on-chain data shows a sharp reduction in XRP exchange reserves just as the token’s price slips below several key moving averages. Over the last month, the value of XRP held on centralized trading platforms has fallen from about $7.03 billion to $5.70 billion, a drop of roughly $1.32 billion. This steep decline in reserves is happening at the same time as XRP price struggles to stay above the $2 level and trades under its 50-day and 200-day moving averages, raising serious questions about liquidity, sentiment, and what might come next for traders and investors.

On the surface, falling reserves might sound bullish, because fewer coins on exchanges can mean less immediate sell pressure. But when the decline in reserves lines up with a slide in price and a break below important technical levels, the picture becomes more complex. Is this simply long-term accumulation and self-custody, or does it signal waning confidence and risk-off positioning? In this in-depth guide, we unpack the latest numbers, the technical backdrop, and the broader forces shaping XRP’s next major move.

latest XRP exchange reserve drop

On-chain analytics tracked by CryptoQuant and reported by Finbold show that between November 10, 2025 and December 10, 2025, the total value of XRP reserves on exchanges fell from approximately $7.03 billion to $5.70 billion. With XRP trading near $2.50 at the start of that period and around $2.08 a month later, that translates into a $1.32 billion reduction, or an 18.83% slide in reserve value. In simple terms, nearly one-fifth of the XRP held on exchanges by value has disappeared from those platforms in just four weeks.

Some of this drop is driven by price action itself. When the token falls, the dollar value of the same number of coins also declines. However, the data shows that the fall in reserve value is not purely a reflection of price. It also coincides with net withdrawals of XRP from exchanges, suggesting that traders are moving coins into cold storage, DeFi, institutional products, or simply off centralized venues for safekeeping.

The result is a double squeeze. On one side, market liquidity is thinning as less XRP is readily available to buy or sell on order books. On the other, price is losing momentum, creating a backdrop of volatility where relatively modest order flow can trigger outsized moves.

How much XRP actually left exchanges?

To understand the magnitude of this shift, it helps to zoom out beyond just the last month. Earlier in 2025, XRP already went through a large-scale exodus from exchanges. In June, more than $1.2 billion worth of XRP exited Binance alone over a one-week period, as balances fell from around 2.85 billion tokens to roughly 2.24 billion. That episode also coincided with a sharp price dip below the $2 mark, underscoring the tight connection between reserve flows, liquidity, and short-term price moves.

More recently, exchange-specific data shows that XRP reserves on Binance have dropped to about 2.7 billion tokens, one of the lowest balances ever recorded on the platform. Since early October, roughly 300 million XRP have been withdrawn from Binance alone, a trend far too consistent to write off as internal reshuffling. This is not an isolated phenomenon either. Other major venues have reported similar declines, painting a picture of broad-based outflows rather than exchange-specific issues.

Taken together, these numbers suggest that XRP exchange reserves shed $1.32B is not a one-off headline, but part of a larger structural trend. Across 2025, XRP has oscillated between phases of heavy outflows and temporary inflows, reflecting the tug-of-war between short-term traders and long-term holders who prefer self-custody and institutional-grade products.

Why traders are pulling XRP off centralized platforms

There are several reasons why XRP holders might be withdrawing coins from centralized exchanges even as the price struggles:

One factor is security and ownership. After a decade of high-profile exchange hacks, collapses, and regulatory actions, many crypto users have embraced the “not your keys, not your coins” mindset. Moving XRP into hardware wallets or non-custodial solutions gives holders direct control and reduces counterparty risk.

Another driver is the rise of institutional vehicles and ETFs. As spot XRP ETFs and other structured products gain traction, some investors prefer to gain exposure via regulated channels rather than keeping large balances on crypto exchanges. The launch of new XRP-linked exchange-traded vehicles in the US has already reshaped demand and encouraged some holders to shift positions.

Finally, there is the simple reality of market strategy. When traders anticipate volatility or believe that a major trend is brewing, they may pull coins off-exchange to lock in long-term positions or wait for clearer signals. The current environment, where XRP exchange reserves are falling while price trades under key technical levels, fits that mold.

XRP price slips below key moving averages

At the same time that reserves are shrinking, XRP price is struggling technically. As of the latest data, XRP trades around $2.08, up slightly on the day but down about five percent on the week. More importantly, the token sits below its 50-day simple moving average (SMA) near $2.30 and its 200-day SMA around $2.62, a configuration that signals a bearish short- to medium-term trend.

Moving averages act as dynamic support and resistance zones. In an uptrend, price typically stays above them; in a downtrend, it trades below. When shorter-term moving averages drop beneath longer-term ones, many traders read this as confirmation that momentum has shifted to the downside. For XRP, trading beneath both the 50-day and 200-day SMAs confirms that bears remain in control, at least for now.

The Relative Strength Index (RSI) adds another layer to the picture. XRP’s 14-day RSI currently sits near 47, a neutral reading that suggests neither extreme fear nor excessive greed. The indicator points to a market that is pausing rather than capitulating, leaving room for both a relief bounce and a deeper correction depending on incoming news and flows.

What falling below the 50-day and 200-day MAs means

For many technical traders, the 50-day moving average reflects intermediate trend direction, while the 200-day moving average maps the broader market cycle. When price trades below both, as XRP currently does, it often indicates a phase of distribution or consolidation rather than a sustained bull run.

In practical terms, this structure has several implications. First, rallies into the 50-day SMA around the $2.30 region are likely to attract sellers, creating a “ceiling” where short-term speculators may look to exit or open short positions. Second, the 200-day SMA closer to $2.62 becomes a major hurdle; reclaiming this level would be a powerful signal that the XRP price trend is turning.

Until either of these levels are convincingly broken on strong volume, many chart watchers will treat XRP as being in a downtrend within a larger consolidation range, rather than in a confirmed uptrend.

Support, resistance and the current trading range

The psychological $2 level has been acting as a key support zone for much of 2025. Several recent sell-offs have probed below this mark, only to see buyers step in and prevent a deeper breakdown. On the upside, the $2.30–$2.50 band that overlaps with the 50-day SMA and prior horizontal support has flipped into a tough resistance area.

This creates a relatively tight trading box. If XRP convincingly breaks below $2 with high volume and fails to reclaim it quickly, the market could see stops cascade and push price toward lower supports. Conversely, a strong bounce that pushes the token back above $2.30 and holds there would hint that bulls are regaining control, especially if accompanied by fresh on-chain inflows and improving sentiment.

For now, the combination of shrinking XRP exchange reserves, sub-trend moving averages, and neutral RSI paints a picture of cautious consolidation rather than a runaway trend in either direction.

On-chain signals from Binance and other major exchanges

Beyond global reserve values, exchange-specific data offers a more granular view of what is happening under the hood. Binance, the world’s largest crypto exchange by trading volume, has seen its XRP balances fall to around 2.7 billion tokens, a multi-year low. Since October 6, on-chain trackers estimate that roughly 300 million XRP have exited Binance, signaling persistent net outflows rather than short bursts of activity.

Other major exchanges, including Upbit and several leading derivatives platforms, show similar patterns of declining XRP exchange reserves over recent months. At the same time, there have been periods earlier in the year where reserves briefly surged, with inflows of over 1.2 billion tokens in a single day as traders moved coins back onto exchanges during key price tests near the $3 level.

This push-and-pull reveals a market that is extremely sensitive to price levels, news, and macro conditions. When XRP pushes into resistance zones or hype builds around potential breakouts, coins flow back onto exchanges as traders prepare to sell or trade more actively. When fear rises or long-term conviction strengthens, reserves drop as holders switch to self-custody or more passive vehicles.

Record-low Binance balances and long-term accumulation

The decline in Binance’s XRP reserves is particularly noteworthy because Binance has historically been one of the deepest liquidity pools for XRP trading. A drop to record-low balances suggests that a growing share of the circulating supply is in the hands of long-term holders who are unwilling to sell at current levels.

Analysts often interpret this pattern as a bullish long-term signal. When coins leave exchanges and are locked away, the “free float” shrinks. In such conditions, if demand picks up even moderately, the resulting supply squeeze can fuel rapid price advances because there are fewer tokens available to absorb buy pressure.

Of course, the inverse is also true. If sentiment sours and holders rush to move coins back to exchanges, this can create a wave of new supply that overwhelms bids and accelerates downside moves. That is why traders watch exchange reserve metrics so closely: they act as a kind of “X-ray” into the hidden supply dynamics behind the price.

Liquidity, volatility and the risk of a supply shock

As XRP exchange reserves shed $1.32B, the market is becoming more fragile from a liquidity standpoint. A smaller pool of coins on order books means that large trades can move price further, especially during periods of heightened volatility or news-driven events.

In the bullish scenario, this reduced liquidity sets the stage for a supply shock. If positive catalysts emerge, such as regulatory clarity, ETF inflow surges, or major institutional partnerships, new buyers may find themselves competing for a smaller pool of available XRP, pushing price higher and faster than expected. Similar dynamics have driven explosive moves in other cryptocurrencies during past cycles.

In the bearish case, thin liquidity cuts both ways. If broader crypto markets stumble, macro conditions deteriorate, or negative news hits XRP specifically, there may not be enough resting bids to cushion the fall. This could result in sharp wicks and “air pockets” on the chart, where price skips several levels as stop-loss orders and liquidations cascade.

Macro forces shaping XRP’s next move

While on-chain data and technical indicators offer valuable insights, XRP price does not exist in a vacuum. Broader market forces play a major role in determining whether the next big move is up, down, or sideways.

One of the strongest influences in 2025 has been the rise of spot crypto ETFs and institutional products. Bitcoin and Ether ETFs have already reshaped capital flows, and newly launched XRP-focused vehicles are starting to do the same. As ETF issuers accumulate coins to back their products, they effectively remove supply from active trading, reinforcing the squeeze created by exchange outflows.

At the same time, macro-economic indicators like inflation data, interest rate expectations, and global risk sentiment affect appetites for risk-on assets, including XRP. Periods of monetary tightening or geopolitical stress tend to push investors toward cash and safe havens, while easing cycles and bullish equity markets can spark renewed interest in high-beta assets like cryptocurrencies.

Finally, XRP still reacts strongly to regulatory developments and legal clarity around Ripple Labs, cross-border payments, and the status of the token in major jurisdictions. Although key legal battles have already shaped much of XRP’s narrative, ongoing policy shifts in the US and other markets continue to influence institutional adoption and investor confidence.

How ETF demand and self-custody trends interact

The combination of rising ETF demand and falling exchange reserves is especially important. When ETFs or other institutional vehicles buy XRP, they typically source liquidity from exchanges or large OTC desks. If those exchanges already hold fewer coins, the competition for supply intensifies.

Meanwhile, retail and whale holders moving XRP into self-custody reduce the float even further. This creates a layered supply structure where a growing share of the token’s circulation is locked in long-term holdings, cold wallets, and institutional products, leaving a relatively small slice available for active trading.

Whether this ends up fueling a parabolic rally or simply making the market more fragile depends on how demand evolves relative to this shrinking float. What is clear is that XRP exchange reserves shed $1.32B is a symptom of deeper structural shifts in how investors choose to hold and trade the asset.

Scenarios for bulls and bears in the coming weeks

For bulls, the case is straightforward. Shrinking XRP exchange reserves, record-low balances on major platforms like Binance, and steady institutional interest all suggest that supply is tightening. If price can reclaim the 50-day moving average, break back above the $2.30–$2.50 resistance zone, and eventually challenge the 200-day SMA, it would signal that demand is strong enough to push against the reduced float.

For bears, the argument centers on trend and macro risk. XRP is still trading below key moving averages, volume remains muted, and the broader crypto market is facing waves of uncertainty. If price breaks convincingly below the $2 support and fails to recover quickly, it could trigger another leg down, even with lower exchange reserves, as risk-off sentiment spreads.

In reality, both scenarios may play out in stages. Periods of sideways consolidation, range trading, and fake-outs are common when technical and on-chain signals point in different directions. That is why many traders combine technical analysis, on-chain metrics, and macro context rather than relying on a single data point.

What this means for XRP investors and traders

For active traders, the combination of shrinking XRP exchange reserves and sub-trend price action demands extra attention to liquidity, slippage, and risk management. Thin order books can amplify both profits and losses, so position sizing and clear invalidation levels become even more crucial.

Swing traders and longer-term participants often focus on whether XRP can retake its 50-day and 200-day moving averages and hold them as support. Sustained closes above these levels, ideally accompanied by rising volume and improving RSI, would indicate that momentum is shifting in favor of the bulls. Until then, many will treat rallies into these moving averages as potential selling opportunities or areas to reduce exposure.

For long-term XRP holders, the current environment is a test of conviction. On one hand, the steady exodus from exchanges and growing self-custody trends can be read as confirmation that the market is maturing, with more participants choosing to hold through volatility. On the other, the reality of unpredictable regulation, macro shocks, and crypto-specific risks means that diversification, independent research, and careful planning remain essential.

Nothing in these dynamics changes the core principle that cryptocurrencies are high-risk, highly volatile assets. Any decision to buy, hold, or sell XRP should be based on a personal assessment of risk tolerance, time horizon, and belief in the long-term adoption of the underlying technology.

Conclusion

The headline that “XRP exchange reserves shed $1.32b as price slips below key MAs” captures only part of the story. Underneath, the data reveals a more nuanced picture: a market where supply on exchanges is shrinking, self-custody is growing, institutional vehicles are emerging, and price is caught between bearish technicals and potentially bullish structural trends.

On the one hand, trading below the 50-day and 200-day moving averages, muted volume, and a fragile macro backdrop point to caution. On the other, record-low reserves on major exchanges, rising ETF interest, and a tightening float hint at the possibility of a future supply shock if demand rekindles.

Whether XRP’s next major move is a breakout or a breakdown will depend on how these forces interact over the coming weeks and months. For now, the most balanced approach is to respect the data on both sides: acknowledge the risks implied by the charts and macro climate, while recognizing the longer-term potential embedded in shrinking crypto exchange reserves and evolving market structure. As always in crypto, staying informed, flexible, and disciplined is the best edge any participant can have.

FAQs

Q; What does it mean that XRP exchange reserves shed $1.32B?

When we say XRP exchange reserves shed $1.32B, it means that the total dollar value of XRP held on centralized exchanges fell by about $1.32 billion over a one-month period. Part of this decline comes from price moving lower, but on-chain data also shows net withdrawals of XRP from exchanges. In practice, fewer coins on exchanges generally mean reduced immediate selling pressure, but it also signals that liquidity is thinning, which can make price more volatile in both directions.

Q; Is a drop in XRP exchange reserves bullish or bearish?

A drop in XRP exchange reserves can be interpreted in different ways depending on context. If reserves fall while price is stable or rising, it often looks bullish because it suggests accumulation and self-custody by long-term holders, which can set up a supply squeeze. If reserves fall while price is sliding and trading under key moving averages, as now, it can signal investors are cautious, moving off-exchange to wait out volatility rather than actively trading. The signal is therefore mixed and must be read alongside price structure and broader market conditions.

Q; Why is XRP trading below its key moving averages?

XRP is currently trading below its 50-day and 200-day simple moving averages because recent price action has been weak relative to the prior months’ average prices. A series of lower highs and lower lows has pulled price under these trend lines, which many traders use as benchmarks for bullish or bearish momentum. Until XRP can reclaim and hold above these moving averages, the technical outlook remains cautious, even if on-chain data hints at longer-term accumulation.

Q; How do Binance reserves affect XRP price?

Because Binance is one of the largest venues for XRP trading, its reserves have an outsized impact on market liquidity. When Binance’s XRP balance drops to multi-year lows near 2.7 billion tokens, it means there are fewer coins immediately available on its order books. If demand spikes, this reduced supply can accelerate price moves upward. However, if sentiment turns sharply bearish and holders rush to move coins back onto the exchange, the sudden increase in available supply can intensify downward moves as well.

Q; Could shrinking XRP exchange reserves trigger a future rally?

Shrinking XRP exchange reserves increase the odds of a supply shock if demand rises, because there are fewer tokens available to meet new buying interest. Historical episodes where reserves fell ahead of strong demand have, at times, preceded large rallies in various cryptocurrencies. That said, a rally is not guaranteed. A sustained move higher would still require supportive macro conditions, constructive regulatory news, and genuine buyer demand. Reduced reserves simply mean that if those ingredients appear, the resulting price move could be faster and more dramatic than in a highly liquid market.