Bitcoin Price Forecast: Gold Signals BTC’s Dip Below $100K is Nearly Done

Gold Signals BTC’s Dip Below. The latest Bitcoin price forecast is no longer just about halving cycles and crypto-native charts. More and more analysts are watching gold’s breakout and macro trends to understand where BTC price is heading next. When Bitcoin trades below $100K after a major cycle high, the obvious question is whether the bull market is over or whether this is just a deep but temporary correction. Gold’s behavior has become an important signal. A strong gold rally that holds above key resistance supports the idea that the macro “store of value” trade is still alive. If the macro thesis is intact, many analysts argue that BTC’s dip below $100K is closer to the end than the beginning, not a structural top.Gold Signals BTC’s Dip Below.

In this article, we will dive into how gold prices and Bitcoin correlate, why gold’s strength can signal that Bitcoin’s downside is limited, and what on-chain and macro data say about the next phase for BTC. We will also examine historical price action, supply dynamics, and investor behavior to build a thoughtful Bitcoin price forecast rather than a wild guess. Finally, we will wrap up with practical takeaways and FAQs so you can better frame your own expectations for the market.Gold Signals BTC’s Dip Below.

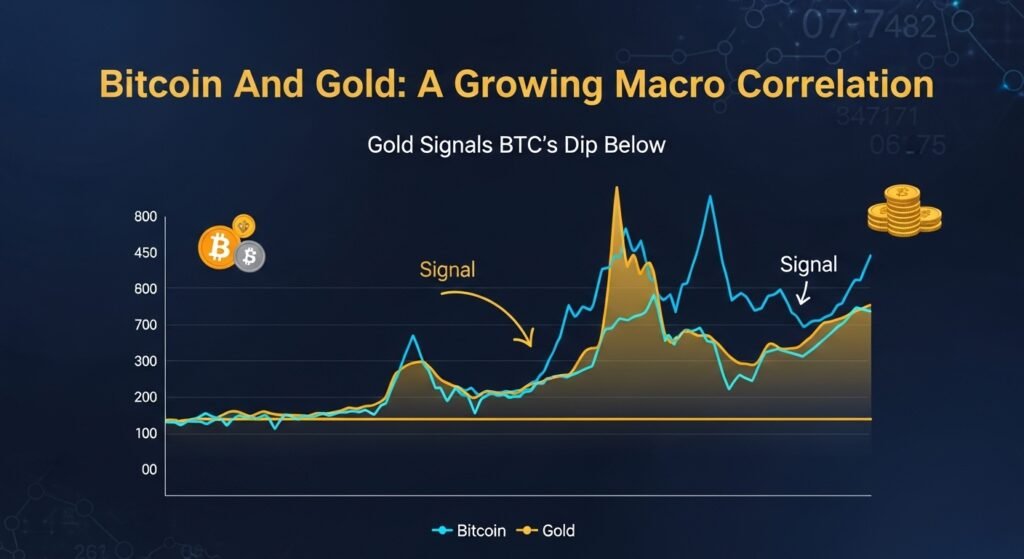

Bitcoin And Gold: A Growing Macro Correlation Gold Signals BTC’s Dip Below

For years, gold was the traditional hedge against inflation, currency debasement, and macro shocks. Bitcoin, on the other hand, started as a niche digital asset. Over time, as BTC’s market cap surged into the hundreds of billions and institutional adoption grew, Bitcoin and gold began to compete for the same “digital vs physical store of value” narrative.Gold Signals BTC’s Dip Below.

Correlation data over the last several years show that during periods of macro stress, Bitcoin’s correlation with gold often increases, while its correlation with risk assets like tech stocks can weaken. This happens because large investors begin treating BTC as “digital gold”, a scarce asset that is ultimately capped at 21 million coins. When gold breaks out to new highs, it sends a message that investors are actively seeking protection against long-term monetary debasement, real yield erosion, or geopolitical risk.

If that story is true, the recent gold strength should not be seen as bearish for Bitcoin. Instead, it implies that the store-of-value trade is still in play. The difference is that gold tends to move more slowly and with less volatility, whereas Bitcoin reacts in sharp rallies and deep corrections. A healthy gold uptrend often sets the stage for the next powerful BTC price move, even if Bitcoin temporarily lags or corrects more aggressively.Gold Signals BTC’s Dip Below.

Why Gold’s Rally Suggests BTC’s Sub-$100K Phase Is Temporary Gold Signals BTC’s Dip Below

When traders build a Bitcoin price forecast, they often focus on halving events, ETF flows, and on-chain metrics. While these are essential, gold’s rally adds another layer of context. If gold was collapsing while Bitcoin fell below $100K, it could signal a broader loss of faith in the store-of-value narrative. Instead, when gold holds near record highs or breaks above long-term resistance, it suggests that investor demand for hedges is alive and well.

Gold’s resilience typically happens alongside expectations of:

Tight or uncertain monetary policy. Persistent inflation or worries about future price instability. Geopolitical tensions or energy shocks.

Those same drivers are fundamentally supportive for Bitcoin’s long-term value proposition. They reinforce the idea that a scarce, non-sovereign digital asset can benefit from the same structural forces that historically favored gold. In simple terms, if the macro environment is good for gold, it is usually not bad for Bitcoin – just more volatile.Gold Signals BTC’s Dip Below.

Therefore, when BTC trades below $100K while gold remains strong, the message is not necessarily that Bitcoin’s story is over, but that the crypto market is digesting excess leverage, speculative excess, or regulatory shocks. These phases feel painful, but they are often part of a normal bull market correction rather than the start of a decade-long bear market.

Historical Corrections: Bitcoin’s Violent Dips In Ongoing Bull Markets

To understand this Bitcoin price forecast, it helps to zoom out. Historically, Bitcoin has experienced brutal drawdowns even within major bull runs. Corrections in the 30% to 50% range have been common, and sometimes even deeper. These moves shook out leveraged traders and impatient speculators but ultimately set the stage for the next leg higher.

In past cycles, Bitcoin often retraced to levels that looked surprisingly low compared to the prior peak, only to later make new all-time highs. During these phases, on-chain data tends to show coins moving from weak hands to strong hands, long-term holders accumulating, and short-term traders capitulating. Even while price appears weak, the underlying supply distribution becomes more bullish.

When we overlay this behavior with gold’s steady or rising price, the picture becomes more compelling. A stable or bullish gold market says the macro driver—fear of debasement, loss of trust in fiat, or desire for safe assets—is still present. That consistency supports the argument that Bitcoin’s sub-$100K period is more likely to be a consolidation or accumulation zone than a permanent ceiling.

On-Chain Signals: Are Long-Term Bitcoin Holders Accumulating?

Any serious Bitcoin price forecast has to consider on-chain metrics, because the blockchain provides transparent data about investor behavior. While specific numbers change daily, the patterns to watch are consistent.

One key metric is the long-term holder supply, which tracks how many BTC are held by wallets that have not moved their coins for a significant period. Rising long-term holder supply usually indicates that experienced investors are accumulating during dips. Another important signal is the realized price and realized cap, which give a sense of the average cost basis of the market and the total capital stored in Bitcoin at its actual paid prices.

When Bitcoin trades below $100K yet on-chain data shows:

An increase in long-term holder balances, A decline in exchange reserves as BTC moves to cold storage, And a reduction in short-term speculative inflows, it strongly suggests that the market is shifting coins from panic sellers to patient believers. Combined with gold’s strength, this pattern reinforces the idea that BTC’s dip is closer to an accumulation phase than a top.

In addition, metrics like MVRV (Market Value to Realized Value) and HODL waves can signal when price is deeply discounted relative to long-term valuations. Historically, when these indicators enter oversold or undervalued zones during a macro environment that still favors hard assets, it has often preceded significant uptrends in subsequent months and years.

Macro Drivers: Inflation, Interest Rates, And Liquidity

Both Bitcoin and gold are highly sensitive to macroeconomic conditions, especially inflation expectations, real yields, and global liquidity. When inflation is high and central banks keep real rates low or negative, investors seek assets that can preserve purchasing power. Gold tends to rally steadily, while Bitcoin can explode higher due to its limited supply and speculative momentum.

If inflation expectations stay elevated while policymakers are constrained in how aggressively they can tighten, the bullish case for both gold and BTC remains intact. Even if Bitcoin temporarily underperforms gold, the structural forces that drive demand for scarce assets continue working in the background.

Global liquidity also matters. Broader risk-off events, forced deleveraging, or regulatory headlines can cause sudden sell-offs in crypto markets, pushing Bitcoin below key psychological levels like $100K. But if the underlying macro backdrop still supports hard assets, these drawdowns are often followed by renewed institutional and retail interest when prices look cheap relative to their long-term thesis.

In this context, gold’s resilience is a confirmation signal. It tells you that the macro narrative has not fundamentally changed. Instead, Bitcoin is dealing with its own internal volatility and the higher-risk part of the investor base. Once the froth is cleared, the same structural tailwinds that benefit gold can again support a strong BTC price recovery.

Technical Outlook: Key Levels To Watch Below And Above $100K

From a technical standpoint, the Bitcoin price forecast around the $100K level revolves around a few key concepts: support zones, resistance clusters, and trend structure. Although exact levels vary across exchanges and timeframes, the psychological round number of $100,000 acts as a landmark.

When BTC trades below this level, traders look for:

Major historical support zones where prior consolidations occurred.

Trendlines from previous cycle lows that remain unbroken.

Volume profile areas where large amounts of BTC changed hands.

If these supports hold and the broader uptrend structure remains intact on higher timeframes, the action under $100K is more likely a correction in a bull market rather than the start of a macro downtrend.

On the upside, regaining and holding above $100K, then breaking prior highs with strong volume, would confirm that the market has absorbed the correction. A convincing breakout, especially if accompanied by continued gold strength and positive on-chain signals, would support projections for significantly higher prices in the following cycle phases. Some long-term models still suggest that, after a cleansing consolidation, Bitcoin could advance to multiples of its previous all-time highs, though the path there is never linear.

Gold As A Confidence Barometer For The Store-Of-Value Trade

Think of gold as a slow-moving gauge of investor confidence in the store-of-value narrative. If gold is breaking down violently while Bitcoin dumps below $100K, it could mean the broader thesis is under serious pressure. But when gold is trending higher or holding firm, it tells a different story: investors still want protection from currency debasement, inflation, and systemic risk.

In that environment, Bitcoin’s volatility is not necessarily a verdict against its long-term value. Instead, it is a reflection of its youth, leverage, and speculative nature. Over time, as institutional infrastructure improves and spot ETFs, custodians, and regulations mature, Bitcoin’s price behavior may become more gold-like—still cyclical, but less violently so.

For now, the combination of:

A strong or stable gold price,

Rising or steady demand for macro hedges,

And continued interest from institutional and retail investors in the digital asset space,

supports the view that BTC’s sub-$100K drawdown is unlikely to mark a permanent ceiling. It is more plausibly a phase in the ongoing maturation of a scarce digital asset in a world still grappling with debt, inflation, and geopolitical uncertainty.

Long-Term Bitcoin Price Forecast: Beyond Short-Term Noise

When constructing a long-term Bitcoin price forecast, it is crucial to distinguish noise from signal. Short-term moves driven by liquidations, funding imbalances, or one-off news events may dominate headlines, but they rarely define the entire cycle. The real drivers of long-term value are:

Bitcoin’s fixed supply schedule and halving events.

Adoption curves across retail, institutions, and nation states.

Macro conditions that favor scarce, non-sovereign assets.

Technological and financial infrastructure growth around BTC.

With gold signaling continued demand for store-of-value assets, and with every cycle bringing more sophisticated investors and more robust infrastructure, the long-term trajectory of Bitcoin remains biased upward, even if it experiences deep corrections along the way.

Sub-$100K price action should be understood in that broader context. Each major cycle has included phases where Bitcoin looked “finished” to casual observers, only for it to later set new all-time highs. While there are no guarantees in markets, the combination of on-chain accumulation, macro tailwinds, and gold’s confirming signal makes it reasonable to argue that BTC’s dip below $100K is closer to its final stages than its beginning.

Risk Factors: What Could Invalidate This Bitcoin Price Forecast?Gold Signals BTC’s Dip Below

No responsible Bitcoin price forecast is complete without addressing risks. Although gold’s strength and macro conditions support the bullish argument, several factors could delay or weaken the expected recovery.

First, an extreme global liquidity crunch or financial crisis could force investors to sell both Bitcoin and gold to cover losses elsewhere. In such a scenario, even a strong long-term thesis might not prevent deeper short-term downside. Second, severe regulatory shocks targeting exchanges, stablecoins, or institutional access to BTC could dampen adoption and delay a sustained recovery above $100K.

Third, technological or competitive risks—such as a major protocol failure, unforeseen security vulnerability, or a dramatically more attractive alternative asset—could also change the risk-reward profile for Bitcoin. While these scenarios are not the base case, acknowledging them is part of building a realistic framework.

Even in these risk scenarios, the continued relevance of gold as a safe haven would remain an important signal. If gold stays strong while Bitcoin suffers from crypto-specific issues, it may imply that the macro thesis is intact but the market is temporarily favoring more established hedges over newer digital ones. In that case, Bitcoin’s path to recovery might be slower, but not necessarily broken.

Practical Takeaways For Traders And Long-Term Holders

For short-term traders, Bitcoin’s volatility around the $100K level will continue to present both risk and opportunity. Intraday swings can be sharp, and leverage can amplify both gains and losses. Traders should pay close attention to liquidity conditions, funding rates, and key technical levels, while recognizing that macro signals like gold’s strength provide an important backdrop, not an intraday trading system.

For long-term investors, the message is different. As long as gold remains strong and on-chain data suggests accumulation by long-term holders, the case that Bitcoin’s dip below $100K is a late-cycle correction rather than a terminal top remains compelling. Dollar-cost averaging, prudent position sizing, and a multi-year time horizon have historically been more effective than trying to time every swing in a highly volatile asset.

Ultimately, the combination of macro conditions, gold’s behavior, on-chain signals, and Bitcoin’s unique supply schedule all feed into a coherent narrative: the store-of-value trade is alive, the digital version is more volatile, and current prices below $100K are more likely to represent a challenging but temporary phase rather than the end of Bitcoin’s long-term story.

Conclusion

Putting everything together, the relationship between Bitcoin and gold offers a powerful lens for interpreting the current market. Gold’s resilience and strength suggest that investor demand for scarce, non-sovereign assets remains intact. Rather than signaling the death of Bitcoin, a strong gold market paired with a sub-$100K BTC price is better understood as a sign of crypto’s internal cycle dynamics—leverage being flushed, weak hands capitulating, and long-term holders quietly accumulating.Gold Signals .TC’s Dip Below

While no Bitcoin price forecast can promise certainty, the evidence points to a scenario where BTC’s dip below $100K is in its later innings rather than the first act of a multi-year bear market. As infrastructure matures, adoption grows, and macro forces continue to favor hard assets, Bitcoin’s long-term potential remains significant.

FAQS

Q. How does gold influence the Bitcoin price forecast?

Gold influences the Bitcoin price forecast by serving as a slow-moving indicator of demand for store-of-value assets. When gold is strong, it suggests investors are still seeking protection against inflation and economic uncertainty, which is fundamentally supportive for Bitcoin’s long-term thesis as a digital store of value.

<strong data-start=”17686″ data-end=”17762″>Q. Why is Bitcoin trading below $100K even if gold is near record highs?

Bitcoin is much more volatile than gold and is influenced by leverage, speculation, and crypto-specific events. Even if gold is near record highs, Bitcoin can temporarily trade below $100K due to liquidations, sentiment swings, or regulatory headlines. This does not automatically invalidate the long-term bullish thesis, especially if macro conditions still favor scarce assets.

Q. Does a strong gold price guarantee Bitcoin will go up soon?

A strong gold price does not guarantee that , but it improves the backdrop for a positive BTC price outlook. Gold’s strength is a signal that the macro environment remains supportive of store-of-value assets. Bitcoin still has its own cycle, and timing exact bottoms or tops is difficult, but gold’s resilience is generally a constructive sign.

<strong data-start. What on-chain indicators support the idea that BTC’s dip is nearly done?

Key on-chain indicators include rising long-term holder balances, falling exchange reserves, and metrics like MVRV moving toward historically attractive zones. When these signals show accumulation and reduced speculative froth while price is below $100K, it supports the view that Bitcoin is in an accumulation phase, not a terminal blow-off top.